There are few moments in life more embarrassing than being denied credit at a store. It is these moments where you truly wish the world would just swallow you up. However, as history (and science) has proved, this simply doesn’t happen.

If this sounds familiar and you have been avoiding returning to the store or making any further applications for credit, below are some great and easy to follow ways to help improve your credit situation.

What’s Your Actual Financial Situation?

The first place to start is with a budget. If you don’t have a budget then you don’t really have any idea of your current financial position. Once you have a budget created, however, you will be able to visualize your position and maybe gather a better understanding of why you may have been denied credit.

Of course, a visual budget also allows you to identify any leaks where money is missing. For example, if you notice a recurring late payment fee, do your best to change your budget around to ensure that you don’t make any more late payments.

Time to Make It a Realistic Budget

Once you have your finances set out in front of you, it’s time to make it not only formal but also realistic.

The reason to keep a budget which you can adhere to is so that you can continue to save a consistent amount of money each month. While it may not seem important to you, credit companies value this financial behavior because it shows that you are able to responsibly manage your outgoing expenses along with putting aside a set level of savings.

When creating a realistic budget, remember that you will need things like entertainment and beauty products, so instead of blowing your budget each time one of these expenses comes around, budget for them and find ways to save. For example, buy a the honest company coupon from Groupon Coupons at the start of the month to use throughout the month as needed. Similarly, consider buying a bulk amount of movie tickets to save on each session and to keep you entertained through the month.

Consolidate Your Debt

If you are only able to pay the minimum amount for each debt then you aren’t improving your financial position. Instead, consider wrapping all of your existing smaller debts into one larger consolidation loan with only one interest rate to manage.

Thes loans work by transferring all of your existing lines of credit into one large and management payment. Not only does this method help you to reduce the amount of interest you will pay but seeing your total debt reduce each month is a great motivator.

When taking on these tips it’s important to remember that improving your credit score isn’t’ something which can happen overnight. However, if you take on the tips above and stick to your plan, the goal of freedom from debt is very achievable.

Comments are closed.

Latest Posts

Recent Posts

- Is Life Insurance Safer Than a Bank? (Understanding Stability of Financial Institutions)

- The Hidden Costs of In-House Payroll Processing for Insurance Companies

- 7 Reasons to Consider a Business Loan

- The Role of a Tax Agent: Expertise and Peace of Mind

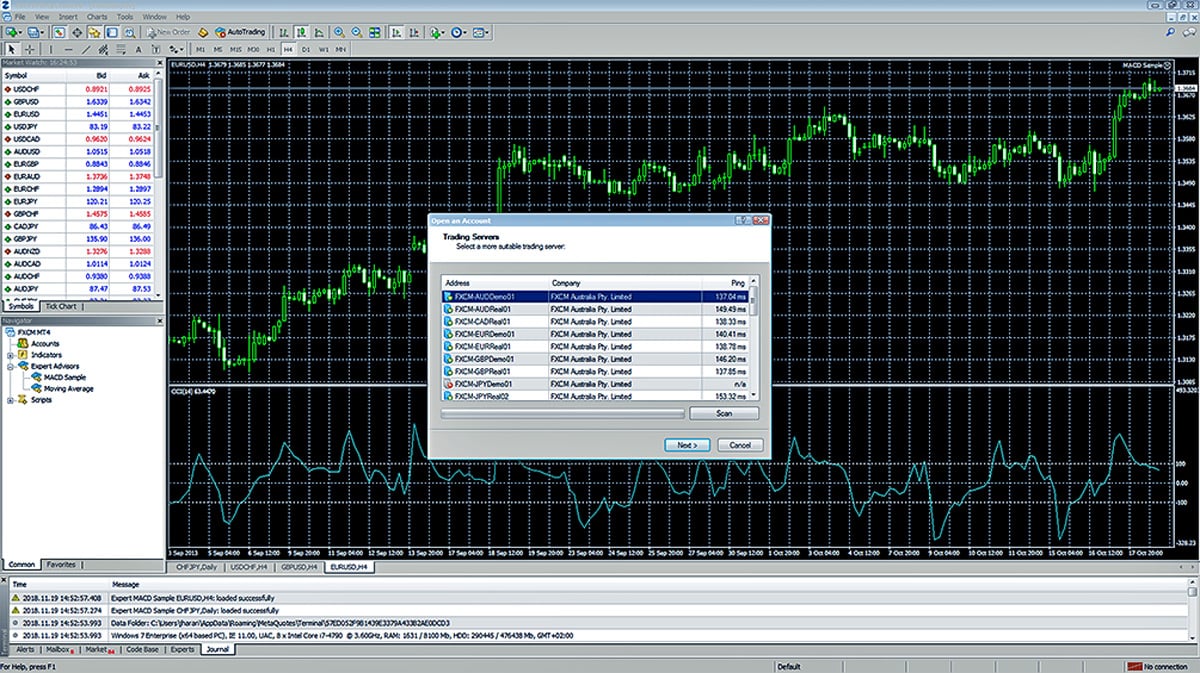

- Advanced technical analysis for British ISA traders: chart patterns and indicators